The rush of nontraditional venture capital into the innovation economy is creating new paradigms for earlier-stage investing. Since the financial crisis, we have seen enormous growth in invested capital by these investors, notably corporate venture capital arms, family offices, sovereign wealth funds and mutual funds.

These nontraditional investors want not only access to the best technology and life science companies but also a front row seat to innovation and the entrepreneurs who are shaping the future. The value-add from each group varies as well. Corporate arms often seek strategic investments that can provide young companies access to partners and customers. Mutual funds are sophisticated investors that can help position a company for a potential IPO in the future. Family offices often have entrepreneurial DNA and can provide patient capital that scales with founders and venture firms over the long-term. Sovereign funds often look to diversify their economies and hopefully bring innovation back to their home country.

Spurred by rising valuations and growing investor sophistication, nontraditional investors are investing at earlier stages. For example, many mutual funds, which typically invested post-IPO, now see that significant value can be realized when the company is still private.

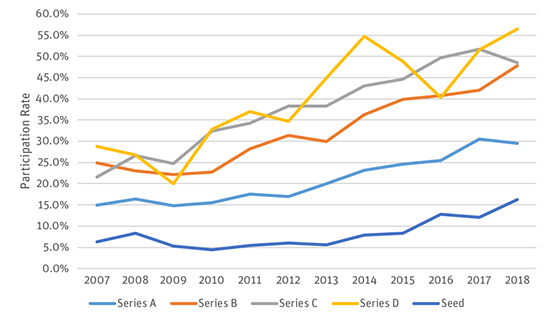

Series D still captures the most activity in terms of capital and deal count by nontraditional investors (defined as when the nontraditional investor serves as a lead investor). Series B deals counts, however, are seeing the fastest growth since 2016, increasing 35 percent. Interest in the seed stage has also increased, and now 16 percent of seed deals involve a nontraditional investor, a 15 percent increase since 2016. Angel and seed investments are larger than ever and have been buoyed by abundant capital and a greater number of investors looking to invest in high-growth technology companies.

Nontraditional investor participation by deal count

Source: PitchBook

The growth of nontraditional investments is helping to dramatically change the startup fundraising timeline, as the additional capital is allowing companies to stay private longer.

The rise of the family office

One type of investor making waves at the earlier end of the spectrum is the family office. Family offices are not new to venture. In fact, they backed some of Silicon Valley’s early venture pioneers — and their impact on the early-stage ecosystem has never been greater. Between 2007 and 2017, family offices have engaged in 1,321 VC financing rounds. The annual volume of such deals has quadrupled between 2009 and 2017. While deal volume is down from a 2015 high, the amount of capital invested continues to grow. In 2018, the value of all VC deals that involve at least one family office could reach $18 billion — breaking the 2015 record year of $15 billion.

Half of all the family offices in the world have been created in the past 15 years, and many of those families want access to innovation, technology and emerging managers. Family offices have recently begun to invest at earlier stages, notably at the angel and seed levels. In fact, between 2014-1H 2018, 26 percent of family office deals are angel or seed investments, up from 4 percent in 2005-2009 period. Thirty-nine percent of deals are in early-stage VC and 35 percent are in later-stage VC. But measured by capital invested, later-stage financings still account for well over 75 percent of the capital invested by syndicates involving family offices.

As their appetite for venture investing grows, family office managers are seeking new strategies, including both making direct investments and building relationships with emerging managers to gain insight and access to technology deals. These managers help family offices navigate the market and can introduce them to direct investment opportunities that have already been scrubbed by the VCs. Family offices also are starting to follow in the footsteps of large institutional investors, focusing on building long-term partnerships with managers and evaluating investment performance across multiple funds.

Direct venture capital/private equity, or co-investing, makes up 13.2 percent of the typical family office portfolio, according to the Global Family Office Report 2017. Almost 70 percent of family offices engage in direct investing. The Emerging Manager Practice at Silicon Valley Bank helps educate family offices about trends and growing sectors and connects them with emerging managers and founders that make a good fit.

A majority of family office money invested in recent years has been funneled toward information technology. More than 97 percent of this investment is in the software space. Family offices also have been involved in notable late-stage VC deals in recent years, including Uber, Robinhood, Adyen and Instacart.

What does the future look like for family offices and other non-traditional investors? They are becoming more sophisticated and increasingly institutionalized as they build better processes for evaluating companies and funds to leverage for their unique value-add. They are hiring connected people who have networks and experience in private company investing. Their continued growth and participation in the innovation economy is providing another source of capital to help tech and life science companies invent the future.