Key Takeaways

- The growth of venture capital investment in Latin America (LatAm) has outpaced most developed economies.

- International investors are increasingly active in the LatAm innovation economy.

- With record dry powder and strong fundraising dynamics, the outlook for LatAm remains positive.

Silicon Valley, fueled by a deep entrepreneurial culture and supportive venture capital, spurred the creation of companies from stalwarts like Facebook and Amazon to recent darlings Zoom and Robinhood. These companies have fundamentally changed how we socialize, shop, work and invest. To date, however, most of these tech companies originated (and operate) in developed markets. Nearly 80% of global venture-backed companies are headquartered in North America or Europe.

However, this trend is quickly changing: In the past 10 years, emerging markets have experienced widespread technological leapfrogging, growing investor willingness to back companies in emerging innovation economies. Latin America exemplifies this transition.

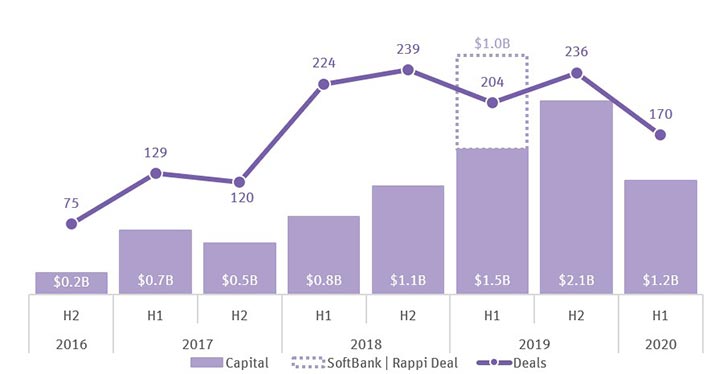

Venture capital (VC) investment and deal count in LatAm

Source: Latin American Venture Capital Association (LAVCA)

Between 2017 and 2019, LatAm VC deals grew at a 33% compound annual growth rate (CAGR). At the same time, VC investment in LatAm grew at a 93% CAGR. The rapid growth of capital illustrates not only the growing innovation economy in LatAm but also increasing investor confidence in the region, as investors are writing bigger checks. SoftBank Group, for example, raised a $5 billion innovation fund focused solely on LatAm in 2021.

Regional hubs are emerging where this funding is most concentrated. Most VC investment in LatAm has gone to Brazil, which received 60% of this investment in the first half of 2020. Brazil has pulled in disproportionate investment partially because the government has established incentives for VC firms, such as highly favorable tax laws for capital gains. São Paulo is also one of the largest tech hubs in LatAm. In addition, Mexico is also showing signs of attracting more VC interest and developing its own hub.

As we know from Silicon Valley, the networks that form in and around tech hubs create a self-perpetuating cycle. High-tech companies attract talent, capital and supporting infrastructure, which fuels the next round of founders and further growth of the ecosystem.

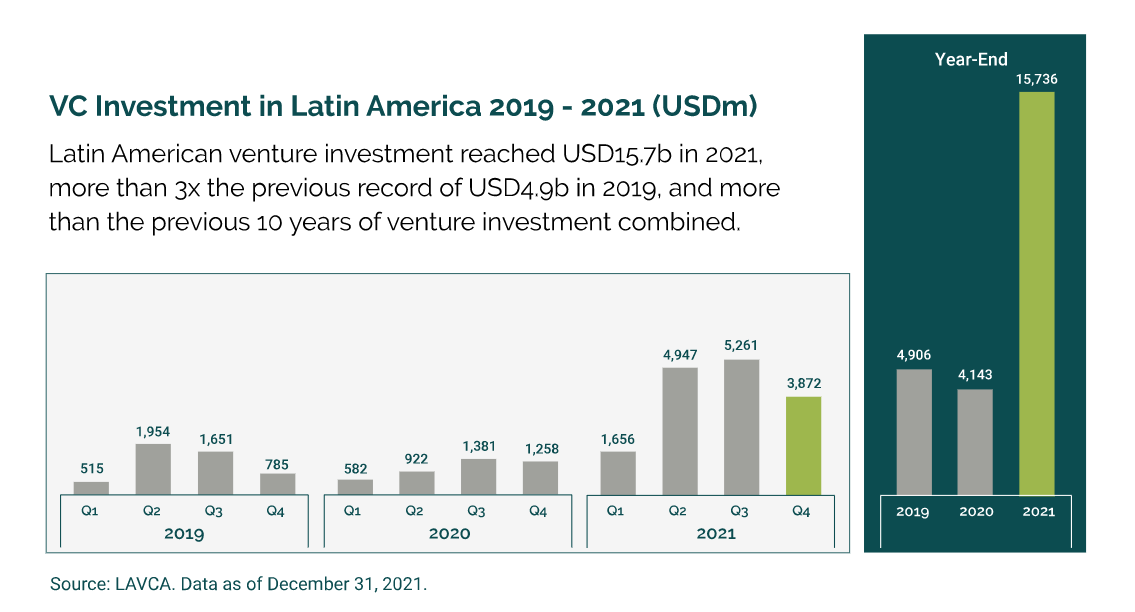

Source: LAVCA, 2022

Venture investment in LatAm started slowing in 2020 during the COVID-19 pandemic, but similar declines occurred in other major innovation economies at that time. LatAm investors faced many of the same challenges: High uncertainty, difficulty conducting diligence remotely and top-of-the-funnel deal flow declined with decreased networking.

Yet, company founders in LatAm had built-in resiliency to weather the storm because they are conditioned to operating in countries with comparatively lower GDP growth, inflation and poor infrastructure. That’s partly why venture investments eventually ended up setting major records in 2021.

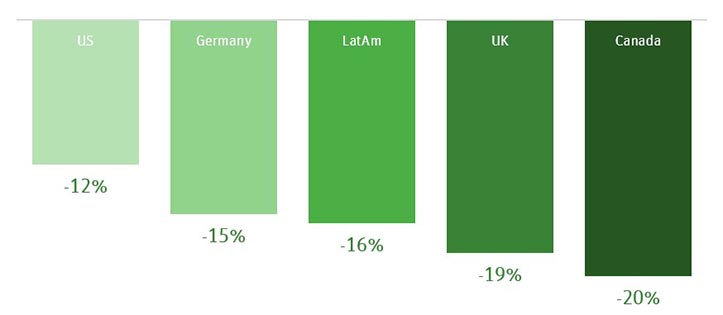

Decline in VC deal activity: H1 2019 to H1 2020

Source: LAVCA, PitchBook and SVB analysis

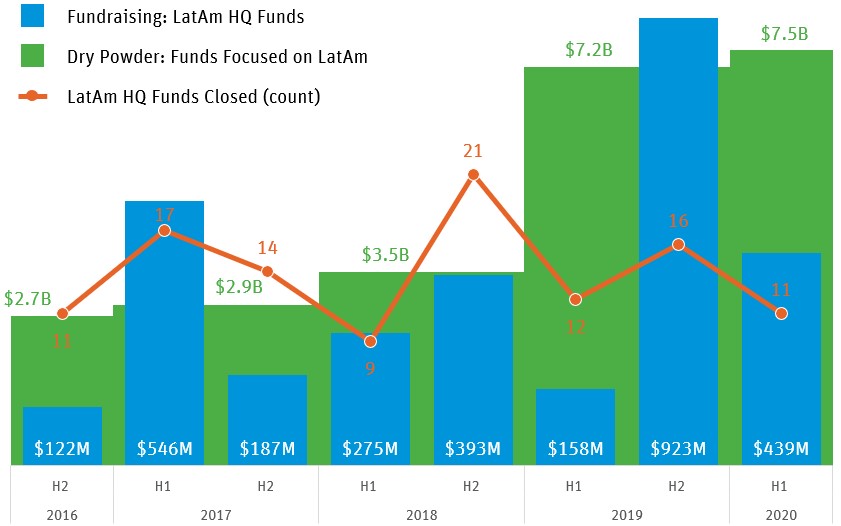

Despite short-term declines, the long-term growth of VC investment is fueled by strong VC fundraising dynamics. This applies not only to funds within LatAm but also to international funds, which are increasingly active in the region. As with most innovation economies, LatAm VC dry powder reached new heights in recent years — signaling a bright future.

VC fundraising and dry powder

Source: LAVCA and Preqin. Note: Dry powder includes private equity growth.

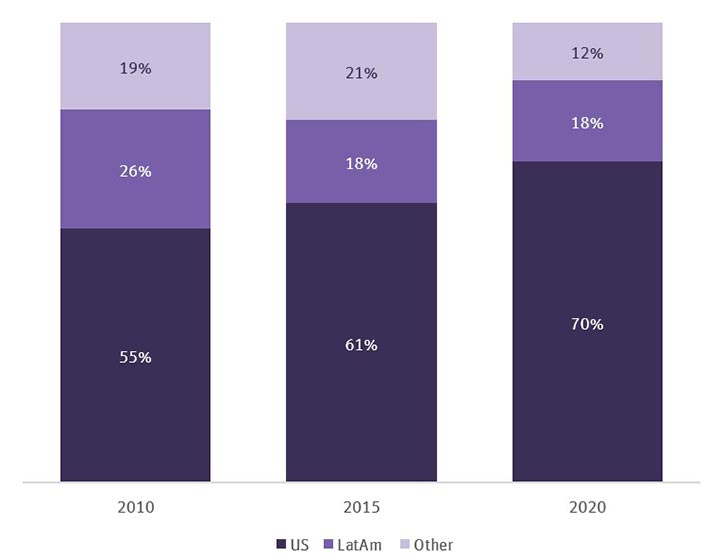

Although VC fundraising is robust in the region, like many emerging VC ecosystems, LatAm depends on foreign capital to fuel its growth. Nearly 70% of funds investing in LatAm are from the US, and 12% are international (excluding the US). In 2010, only 137 US VC funds invested in LatAm. In 2020, that number grew to more than 560. Yet while US participation quickly grew, there is plenty of room to expand. Of all active US VC firms since 2015, only about 30% have invested at least once in LatAm.

Compared with developed countries, Latin America faces higher political, operational and security risks. Plus, the risk increases with the complex logistics of cross-border financial transactions in a new market. These factors discourage some investors from buying in.

The number of investable companies in the US has held steady over recent years, yet the amount of US venture dry powder has reached a record high, which means increased pressure on VCs to look further afield. As such, we at Silicon Valley Bank expect more capital to flow into LatAm in search of investment opportunities that offer favorable valuations for investors as compared with Silicon Valley startups.

Furthermore, in an era when remote due diligence is the norm, there is less reason for international investors not to take action: Everyone looks the same on a 15-inch screen whether you’re a mile away or 5,000 miles away.

Headquarters of funds investing in LatAm by year

Source: PitchBook and SVB analysis. Note: Funds have participated in at least one deal in LatAm in a given year.

The capital flows to distinctly different players in LatAm, compared to most innovation economies. LatAm skews toward the early stage, with 95% of 2019 deals going to early-stage companies. In 2020, early-stage companies also saw six rounds at over $50 million. This trend is demonstrative of the rapid growth and our positive outlook, as some of today’s early-stage companies will become tomorrow’s unicorns.

Yet the ecosystem is much broader than just early-stage companies. Numerous unicorns and decacorns demonstrate the ecosystem’s ability to not only found early-stage companies but also support them as they scale in LatAm and abroad. In two months alone, LatAm had three new unicorns and one unicorn exit. The success of LatAm unicorns will likely attract continued VC investment into the region.

LatAm unicorns: Valuation and country

Source: LAVCA

In 2021, several new LatAm unicorns emerged, including Clara, Merama, Bitso, Kavak, Clip and Jokr. Furthermore, companies like Nubank reached new heights in their valuations.

With an abundance of capital, growing interest from international investors, a vibrant early-stage ecosystem and the proven success of LatAm unicorns, we see a bright future for the innovation economy. While the effects of COVID-19 will undoubtedly continue to stifle investment, the fundamentals of LatAm have not changed.